Mesa County Assessor Concludes the 2023 Reappraisal

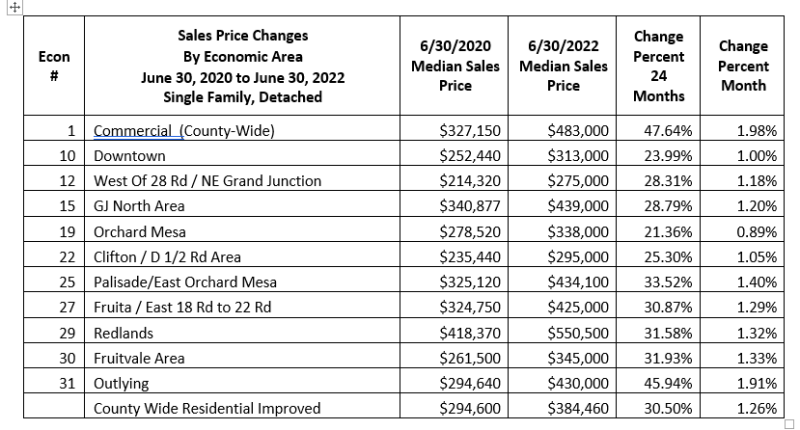

On May 1, the Assessor office will conclude our 2023 reappraisal and mail Notices of Value, (NOVs) to all taxpayers. These Notices will reflect sales, data and analysis from 2021 and the first half of 2022. Arguably, that period reflected one of the hottest and most lopsided real estate markets in recent history, marked by:

- Acute lumber, labor and housing supply shortages

- Unprecedented government stimulus (trillions of dollars)

- Strong demand

- Historically low mortgage rates

- Outmigration from big cities into places like Mesa County

- Cash offers from out of town

- Multiple offers above list price, including escalation clauses

- Bidding wars (2021 Sale price to list ratio was 101.05%)

When you get your NOV, ask yourself this question:

Would my property have sold for that amount on June 30, 2022?

- If you disagree with this valuation, there will be an opportunity for you to protest your value beginning May 1 through June 8.

- Come see us if we have your value incorrect, or visit our website for more information:

https://www.mesacounty.us/departments-and-services/assessor/taxpayer-remedies

- For residential property, we’ll take a closer look at nearby sales used to determine your value.

- For non-residential properties we will also consider an Income or Cost approach to value your property.

- We cannot use current listings or sales. Current data will be used for our next reappraisal in 2025. We can only use sales and other market information from prior to June 30, 2022, and we have to time trend each sale to that date.

- You can research property sales on our website here:

https://www.mesacounty.us/departments-and-services/assessor/research-property-sales

Basic Property Tax Formula

Actual Value, (minus exemption) x Assessment Rate = Assessed Value.

Assessed Value x Mill Levy = Property Tax

In addition to the real estate market increases described above, your assessment rates are changing, (assessment rates are the percentage of your Actual Value that is subject to tax). In 2020 the voters statewide repealed provisions of the Gallagher Amendment to the Constitution requiring a lower assessment rate for residential properties. All assessment rates are now set by your state legislature or by referendums and ballot initiatives each year; they are quite complex and subject to change each year. As of this writing, Senate Bill 22-238 mandates assessment rates as follows:

|

*Assessment Rates by Class or Subclass |

2022 Tax Year |

2023 Tax Year |

2024 Tax Year |

|

Residential (not multi-family) |

6.95% |

6.765% |

Recommended by Division of Property Taxation to Legislature |

|

Residential multi-family |

6.8% |

6.765% |

6.8% |

|

Improved Commercial |

29% |

27.9% |

29% |

|

All other non-residential |

29% |

27.9% |

29% |

|

Ag and Renewable Energy (Including Renewable Energy Personal Property) |

26.4% |

26.4% |

26.4% |

|

Personal Property |

29% |

27.9% |

29% |

|

*Subject to change each year |

|

|

|

- In addition to setting assessment rates, SB22-238 provides a $15,000 Actual Value exemption for residential properties

- and a $30,000 Actual Value exemption for commercial improved properties.

- HB22-1223 exempted from taxation any titled mobile home with an Actual Value of $28,000 or less.

Finally, your assessed value is subject to a mill levy from each taxing entity within your area (school district, county, town, fire district, etc.) to determine property taxes due. These tax authorities set their mill levies during budget hearings in the fall.

What’s looming in the future?

Initiative 21, just filed with the Secretary of State, provides a 3% cap on any property tax bill: https://www.sos.state.co.us/pubs/elections/Initiatives/titleBoard/